Homeowners rejoice! The looming deadline to receive solar incentives on your solar installation has been extended - through 2023. The Federal Investment Tax Credit (ITC) had been in a gradual step-down process over the last few years, and was set to expire in 2022 for residential solar installations. That changed, however, when Congress recently passed a $1.4 trillion federal spending and tax extension package.

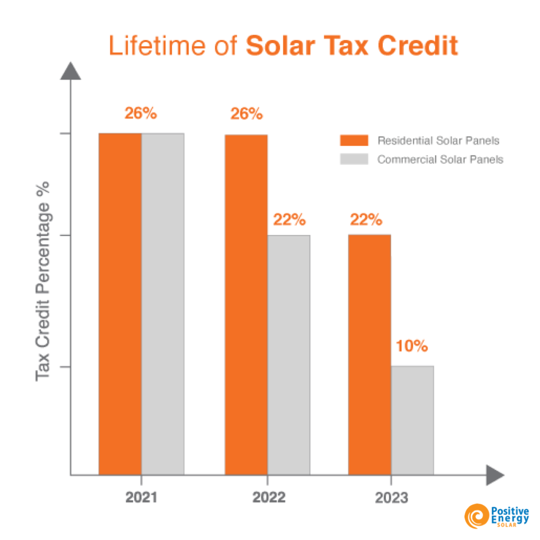

Federal Solar Incentive Extension Timeline

The two-year extension of the federal Investment Tax Credit for solar projects will retain the current 26 percent credit for projects that begin construction through the end of 2022, rather than expiring at the end of 2021 as they would have under existing law. The ITC will fall to a 22 percent rate for projects that begin construction by the end of 2023, and then drop off completely (unless renewed).

This extension to the federal solar incentives comes at a time when COVID-19 has forced people to spend more time in their homes, shifting energy use from the workplace to the home, and many homeowners are turning to solar energy as a way to reduce their monthly utility costs. New Mexico also provides solar incentives - an additional 10% state tax credit, no property or sales tax, as well as net-metering through most electric utility companies. As solar installation in New Mexico (and throughout the United States) continues to grow exponentially, these solar incentives are a relief to those who are eyeing solar projects in 2021 and beyond, and ensure the solar industry in New Mexico will continue to shine for years to come.

Want to learn more about 2021 solar incentives and to discuss solar installation for your home or business? Get started with a free consultation with one of our New Mexico solar experts today!